Why LED Grow Lights Fail and How to Prevent It

LED lighting has revolutionized the lighting industry in terms of electrical efficiency and maintenance with the elimination of lamp replacements.

2025 California Greenhouse Rebate Program

Since 2016, the Cannabis Business Times has published a “State of the Lighting Market” report. The study uses a leading third-party research organization, Readex Research, to ask cultivators questions about what matters most to them in a lighting system, as well as details about their set-up and growing practices. As we continue to learn about the science of plant growth, there have been notable changes in the industry worth paying attention to if you are a serious grower.

Over the course of the last five years, clear trends and patterns have emerged. As we learn more about lighting technology and the powerful effects even small changes can have on plant life, what growers value in lighting technology has radically changed – especially now that the majority of growers report growing inside.

Below, we will break down the latest numbers and explain their relevance to the growing industry.

At California Lightworks, we have long touted the benefits of LED lights for plant growth, and the numbers are showing us more and more growers are beginning to feel the same way about the power of LED lights. Over the years, the Cannabis Business Times has documented a sharp uptick in the adoption of LED lights, with more and more growers preferring LEDs over traditional options.

In 2016, only a fifth of cultivators (21%) reported using LED lights in propagation and LED lights were very rarely used for the vegetative and flowering stage.

Since then, LEDs have become the most prominently used lights for every single stage, transforming LEDs from a somewhat fringe interest to the preferred lighting technology for the majority of growers:

Light intensity is one of the biggest contributing factors to your overall yield. While the human eye can barely perceive differences in light intensity, even small fluctuations can have a powerful effect on plant growth. In recent years, new research on light intensity and its effect on plants has caused light intensity to become a major concern for growers.

In the 2020 study, 84% of participants said light intensity was a crucial factor in the decision-making process when it comes to choosing illumination technology. Other important factors include product warranty (75%), scientific research supporting the product (75%), energy efficiency (73%), and price (63%).

As the industry grows – and with legalization paving the way for mainstream research and conversation – more growers are becoming aware of the science behind their practices. It is therefore no surprise data-driven cultivation is on the rise.

In 2020, 95% of growers say they measure at least one growing parameter. This means light manufacturers should be aware of what metrics matter most to growers in the future. Popular parameters include:

In order to gain context for their data, CBT always asks growers for details on their facilities and the money they spend on their operations. In 2020, indoor growing that relies entirely on artificial lighting remains dominant. As the market grows, there are fairly substantial differences in spending, with growers spending anywhere from over $200,000 to less than $5,000 on their operations.

The majority of growers (85%) reported growing in an indoor facility where they rely exclusively on lighting technology, while 29% reported they grow in a greenhouse and use supplemental lighting. Grow sizes varied considerably in the study, ranging from 50,000 square feet or more (19%) to less than 1,000 square feet (also 19%).

Money spent on lighting also varied greatly, with numbers ranging from over $200,000 to less than $5,000:

The CBT’s annual “State of the Lighting Market” report is an invaluable resource for anyone with a vested interest in the industry. With the LED revolution now well underway, and more well-researched information available than ever before regarding the science of plant growth, we can expect to see major changes in the coming years as growers come to recognize best practices to improve their yields.

Chief Executive Officer

LED lighting has revolutionized the lighting industry in terms of electrical efficiency and maintenance with the elimination of lamp replacements.

Made in California Since 2008.

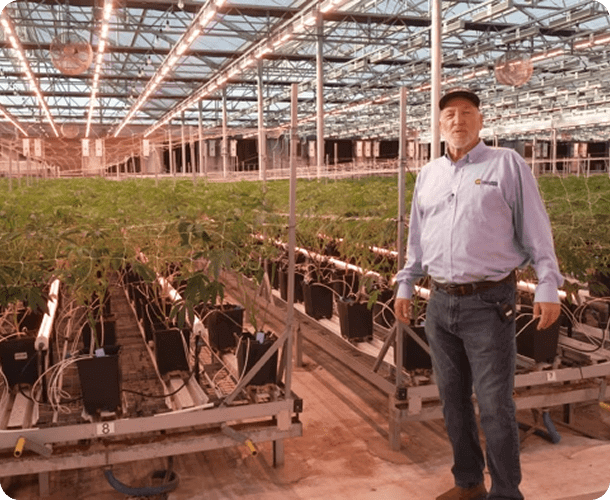

Proudly made in California, California LightWorks engineers high-performance LED grow lights that deliver next-generation results for commercial and home growers alike.